As JAC's deal to sell its factory assets comes to a deadline, rumors that Nio will buy them and announce its own car-making qualifications are circulating widely on Chinese social media.

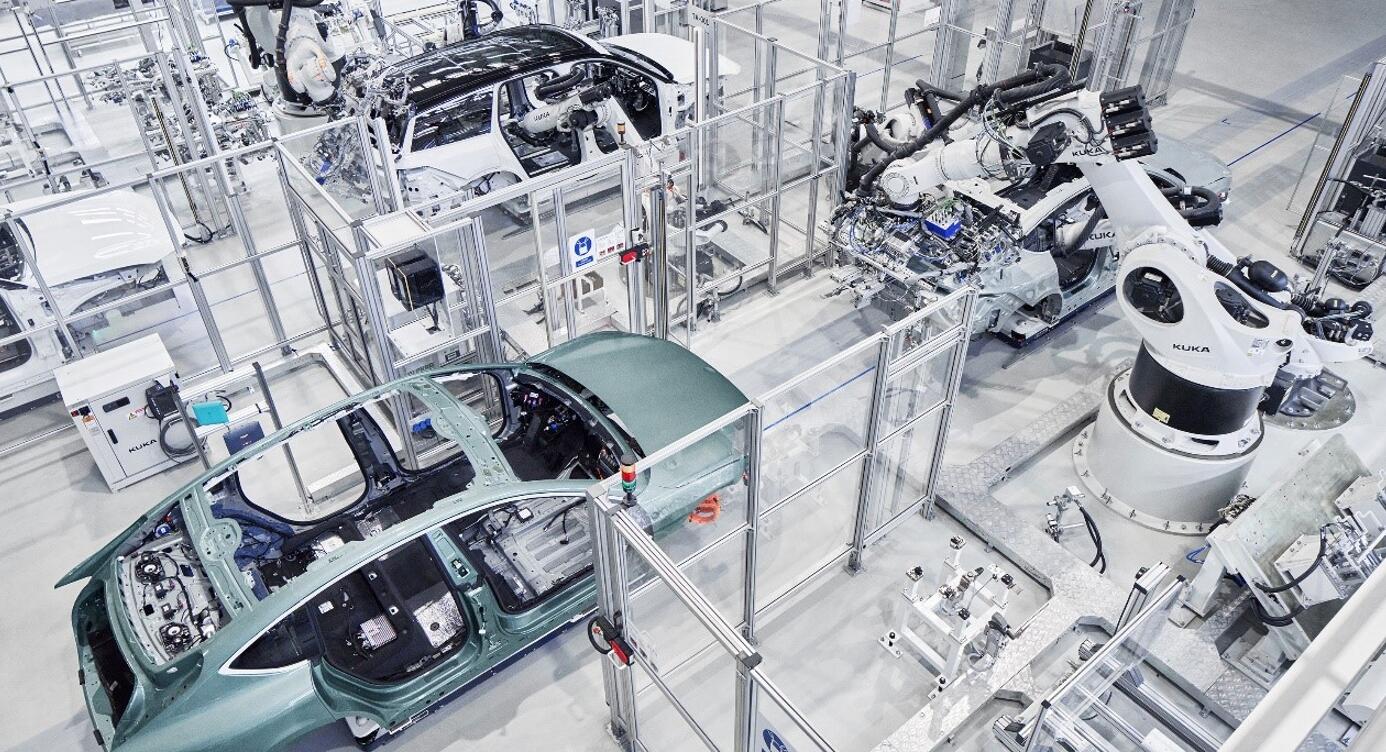

(Image credit: Nio)

Nio (NYSE: NIO) is rumored to announce soon that it will buy the factory assets being transferred by its car-making partner, Anhui Jianghuai Automobile Group (JAC), and will produce vehicles with its own qualifications.

JAC announced plans on October 19 to transfer billions of yuan worth of factory assets in three packages, including Nio's F1 and F2 plants in Hefei, Anhui province.

The three asset packages were listed on the website of the Anhui Assets and Equity Exchange on November 7, with a December 4 deadline for listing, according to documents seen by CnEVPost.

They are state-owned assets, and purchasers are required to pay the transfer price in a lump sum within five working days of the effective date of the transaction contract, according to the documents.

Following JAC's announcement in October, several local media outlets reported that Nio could acquire the assets and seek its own electric vehicle (EV) production status.

Nio did not confirm these reports at the time, but said the move by its vehicle production partner would not affect its production and operations.

As the transfer of these JAC assets came to a deadline, rumors emerged on Weibo that Nio would be the buyer of these assets.

"Nio may announce its independent vehicle manufacturing qualification today, this is indeed, as @Harry_AD said, something that will witness history and may be the first in China's automotive industry to get a production qualification on this route," the CEO of local automotive website Xchuxing wrote on Weibo today.

@Harry_AD is Harry Wong, Nio's head of smart driving products and experience, who said earlier on Weibo that today will be something to witness history.

"Today we're going to witness history and I will stop updating (Weibo) before returning to Shanghai, " Wong said on Weibo early this morning.

Many other prominent car bloggers posted similar speculations on Weibo. If it turns out to be true, then Nio is expected to independently manage the two current factories.

It's worth noting that Nio will announce its third quarter unaudited financial results on Tuesday, December 5, before the US markets open. Anything that may be announced today is expected to be the focus of Wall Street analysts on the earnings call.

The assets transferred have a net book value of RMB 4.2 billion yuan ($590 million) and an appraisal value of about 4.5 billion yuan, JAC said in its October announcement, adding that the move was aimed at optimizing its asset structure.

The asset disposal will not affect JAC's normal production and operations and does not involve staffing arrangements, the company said.

Of the information that has been previously disclosed, not much has been said about the Nio F1 and F2 plants, leaving many wondering how Nio and JAC has been work together on plant management.

Before 2019, production of Nio vehicles was done by JAC, the EV maker's vice president for manufacturing operations, Ji Huaqiang, told English-language media, including CnEVPost, when he hosted a media tour of the F2 plant in Hefei late last month.

Later, the two formed a joint venture called Jianglai, which is responsible for the manufacturing process of Nio vehicles as a whole, Ji said.

On March 31, 2021, Jianglai was formally established with a registered capital of RMB 500 million, initially 49 percent owned by Nio and 51 percent by JAC, according to a previous CnEVPost report.

In April 2022, Nio increased its stake in Jianglai from 49 percent to 50 percent.

Nio's product design and development is done by Nio, and workers at the factory are recruited by Jianglai, Ji said last month.

($1 = RMB 7.1335)